Consumers express regulatory needs in the sharing economy

Published on 28/11/2022 Written by Andrew Blair.

The sharing economy helps people earn money from underused resources, but will a regulatory backlash slow down the growth of this economic model? Research by Software Advice indicates a regulatory need across sharing economy sectors in Australia. We find out what concerns consumers and what powers the sharing economy.

In this article

The sharing economy consists of online platforms that function via peer-to-peer systems and connect users who want to exchange products or skills. Online user reviews on these platforms validate the quality and credentials of the products and services offered. These platforms not only unlock the value of underused resources but also cut out the middleman to further reduce product and service costs.

What is the sharing economy?

The sharing economy is an economic model that involves individuals buying or selling access, which is usually temporary, to goods or services and is often facilitated by an online platform.

Due to the dynamics and evolution of this model, the sharing economy is also referred to as the shareconomy, collaborative consumption, collaborative economy, gig economy, and peer economy.

The term ‘sharing economy’ covers a host of online economic transactions that include business-to-business (B2B) interactions. The following online platforms are examples that have joined the sharing economy:

- Co-working platforms: companies that provide shared office space for freelancers, entrepreneurs, and remote employees

- Peer-to-peer lending platforms: companies that allow individuals to borrow money from an investor, usually at a cheaper rate than traditional credit-lending entities

- Fashion platforms: a site where individuals can sell or rent their clothes

- Freelancing platforms: a site to find or hire freelance workers for temporary jobs

The success of pioneer platforms such as Airbnb and Uber spurred the rapid growth of the sharing economy, and the industry is forecast to be worth $335 billion by 2025. However, due to rapid growth and the evolving nature of this business model, how will the sector face challenges in the form of regulatory uncertainty and concerns about its potential abuses?

Software Advice surveyed 1,008 consumers in Australia to find out how they interact with the sharing economy and their perceptions of its advantages and disadvantages. All participants understood the definition of the sharing economy we provided at the beginning of the survey. You can find the entire methodology at the end of this article.

38% of Aussies participate in sharing economy practices

Only 12% of respondents knew exactly what the term ‘sharing economy’ meant before we provided them with the definition. However, the evolving nature of this economic model and its terminology may account for this, as around a quarter (26%) of respondents were familiar with the concept but not the name. Despite low awareness of the concept, 38% of the survey field indicated that they participate in sharing economy practices. The following data points in the article will mostly focus on responses from these participants.

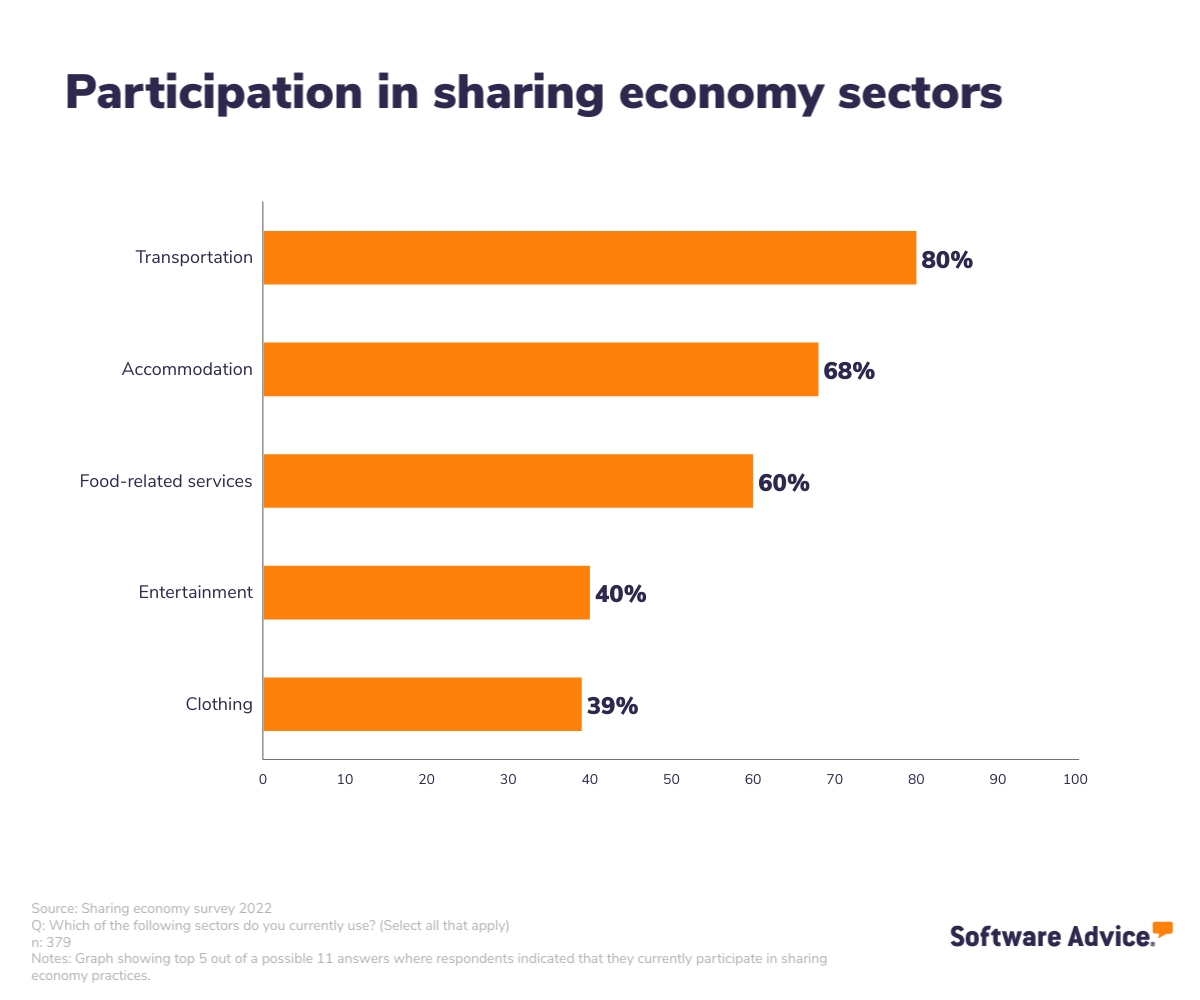

We looked to see which sectors of the sharing economy had the highest number of participants. Our survey found that the transportation and accommodation sectors dominate Australia's sharing economy market.

Transportation services, including ride- and car-sharing, are the most popular among users, with 80% of respondents using these sharing economy services. This may suggest a lack of transport services or that consumers like to use these services due to ease of use or competitive prices in comparison to traditional taxi services, for example. The demand for transportation services may also highlight opportunities within the sector.

The high percentage of users or demand in the transportation sector may be due to the majority (62%) of Australian respondents living in suburban areas, where public transport may be limited. It may be more convenient for suburban residents to use ride- and car-sharing services instead of their vehicles to avoid parking in urban areas.

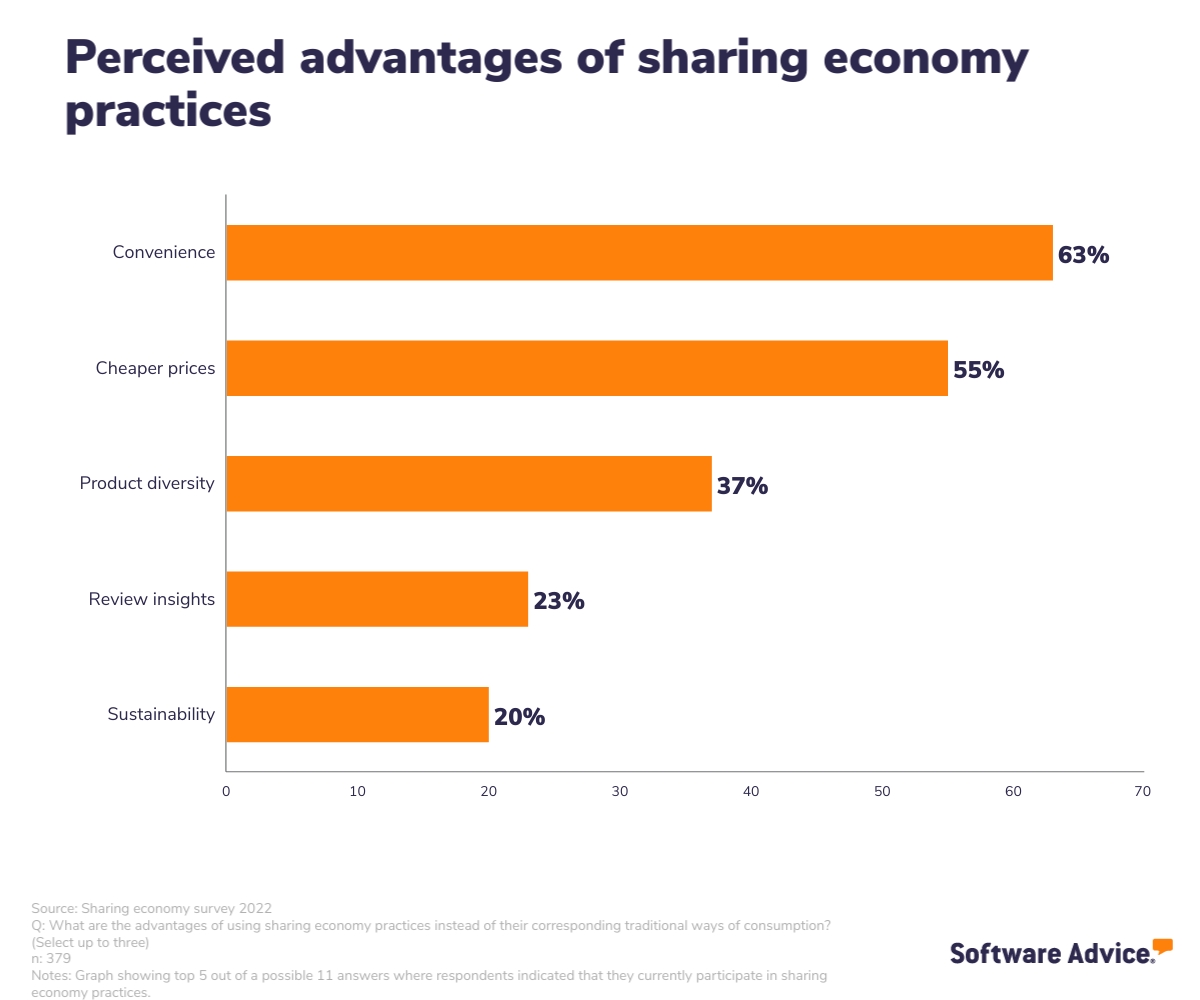

Convenience satisfies users in the sharing economy

When we asked survey-takers to select up to three advantages they perceived in using sharing economy practices instead of their corresponding traditional ways of consumption, convenience was the most frequently cited by 63% of the respondents. A high percentage of consumers using transportation services in the sharing economy confirms the convenience of using these services over alternative transport options.

Although Aussie consumers most commonly cited convenience as an advantage, over half (55%) of the respondents said sharing economy practices are cheaper than traditional ways of consumption. Sharing economy practices are highly competitive in price and have disrupted conventional businesses. The sharing economy revealed an opportunity to slash prices by embracing underused resources and through an untapped independent contractor workforce that is not usually required to pay costly regulation fees. However, although cheaper products and services may appeal to consumers, these may come with hidden flaws due to being unregulated. We then asked consumers what problems they associate with the sharing economy model.

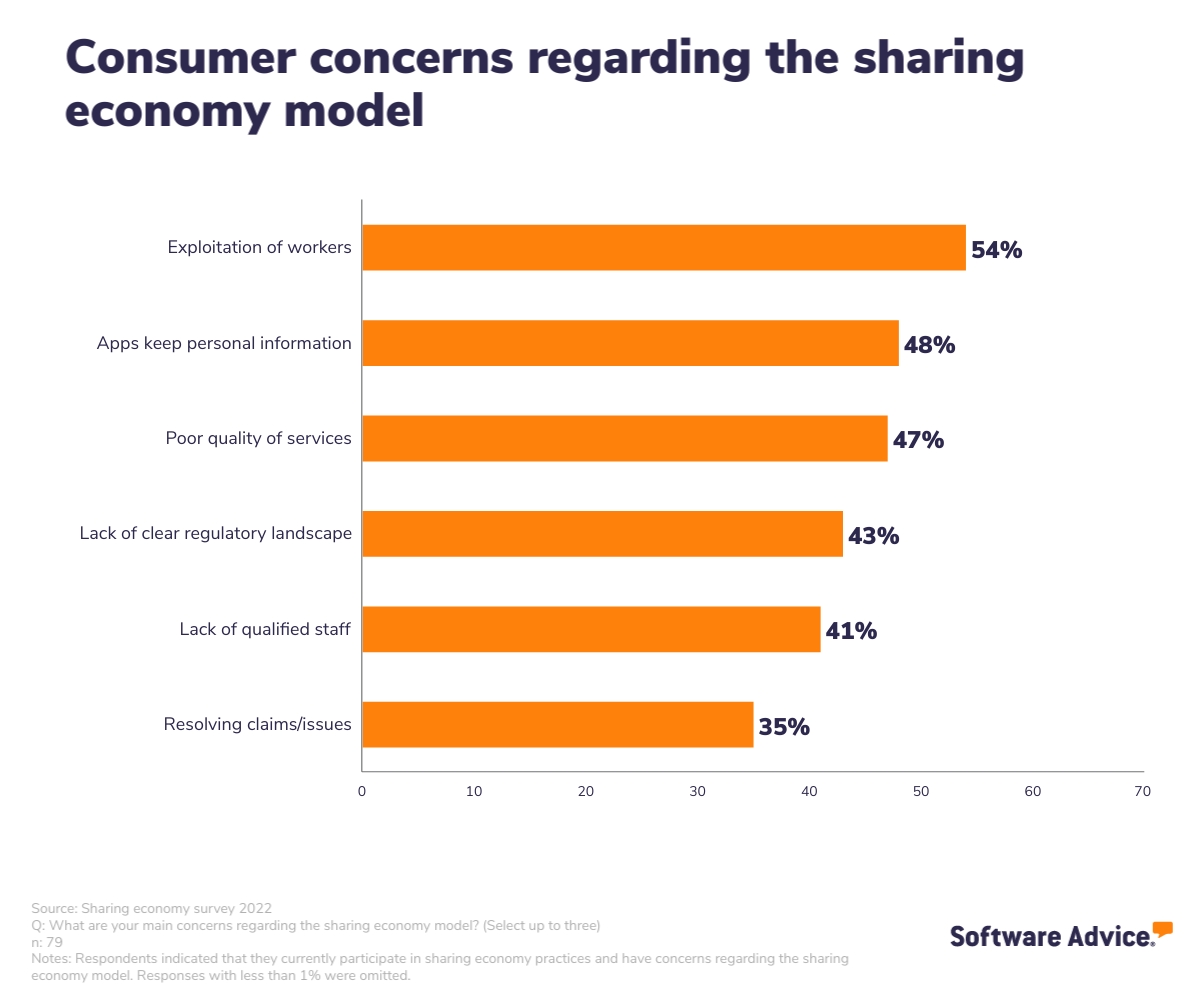

Worker exploitation in the sharing economy concerns consumers

Worker rights in the gig economy have come under scrutiny and raised questions about the fairness of sharing economy platforms as a source of employment. As independent contractors, gig economy workers are not usually covered by employment laws that regulate the minimum wage, holiday pay, and other benefits. As such, of those survey-takers who expressed concerns, over half (54%) said the exploitation of workers was their main concern regarding the sharing economy model. Amid occurrences of data breaches and consumer trust issues regarding data protection, 48% of concerned respondents said the retention of their personal information is a major concern as the majority of these services work through an app.

Sham contracting in the gig economy

Sham contracting involves a company employing an individual as an independent contractor by misclassifying them as such instead of as an employee. Gig economy platforms must ensure that gig workers are fully aware of their work arrangements to avoid being misclassified.

The Fair Work Act outlines how gig economy platforms can evaluate the differences between independent contractors and employees to identify possible misclassification, which includes when a gig worker:

- Has an obligation to accept work

- Wears a company uniform

- Makes use of company transportation

- Is obligated to work

- Has fixed shifts

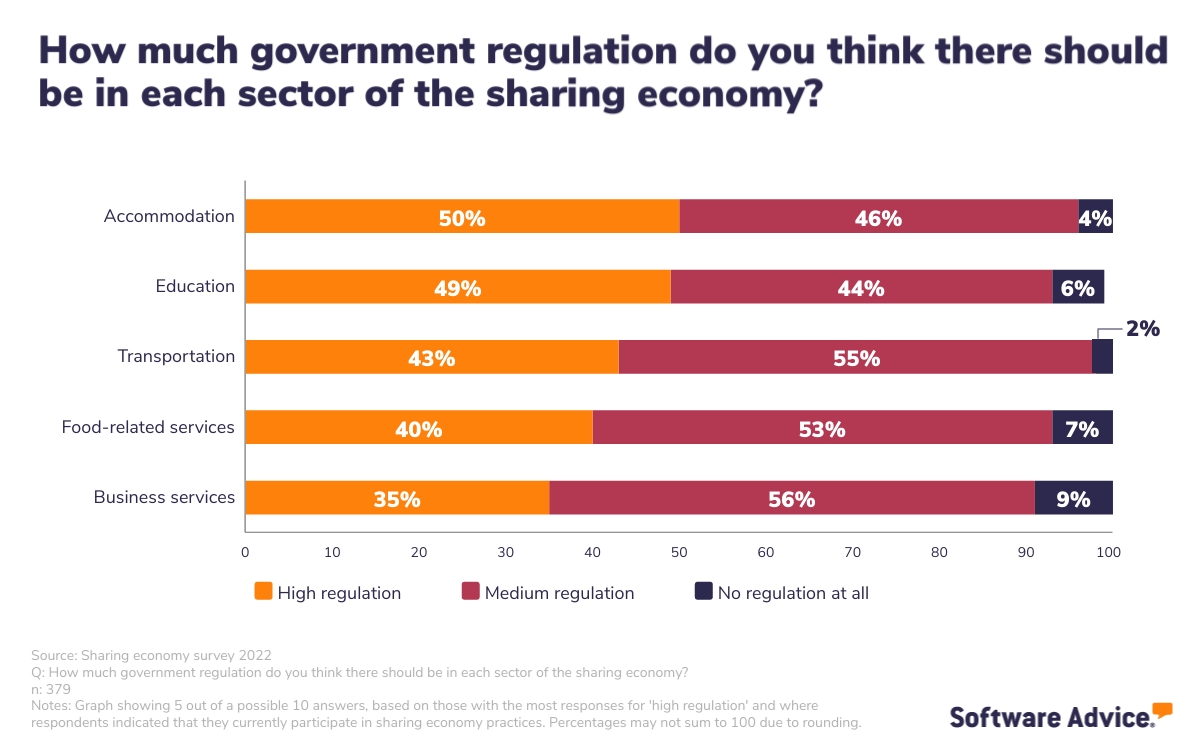

User emphasis on government regulations

In some sectors, there are grey areas not regulated by the government. Only 29% of respondents who participate in the sharing economy selected this as a disadvantage to using these practices instead of traditional ways of consumption. However, 43% of respondents with concerns about the sharing economy expressed the need for a clear regulatory landscape.

Regulatory uncertainty occurs when unlicensed individuals offering rental or temporary access services don’t follow specific regulations. Lack of regulatory control enables unlicensed individuals to use sharing economy platforms to charge lower prices than traditional business methods that adhere to costly regulations. There is a general consensus among 82% of participants in the sharing economy that governments should do more to regulate its practices.

The lack of imposed government regulations could lead to potential abuses, such as false advertising. As a result, users of sharing economy platforms may need to be extra vigilant. Two-thirds (66%) of participants agreed that they carefully check if they are protected in terms of consumer guarantee rights to a repair, replacement, or refund before paying for a product or service. Unregulated platforms that want to build trust should be transparent about consumer rights and inform their customers about the action they will take in the unfortunate event of a faulty or misleading product.

Consumer rights in the sharing economy

Understanding consumer rights can help protect customers from malpractice in the sharing economy and ensure online platforms follow best practices. According to the Australian competition and consumer commission (ACCC), consumers have the same rights as when making store purchases. Still, these may not apply if they buy from a person who is undertaking a one-off or infrequent transaction. However, sharing economy platforms should:

- Provide transparency on protection if things go wrong and tell consumers what they are or are not covered for in addition to their consumer guarantee rights to repair, replacement, or refund.

- Monitor traders that engage in misleading or deceptive conduct or make false representations.

For small to midsize enterprises (SMEs) to help safeguard their customers from potential abuses in sharing economy services, they can enable customers to leave reviews and ratings of the products or services on the platform. Sharing platforms should moderate reviews and ratings by eliminating suspicious or fake reviews and also ensure that the reviews are listed in the order they are received.

Reviews are invaluable on sharing economy platforms

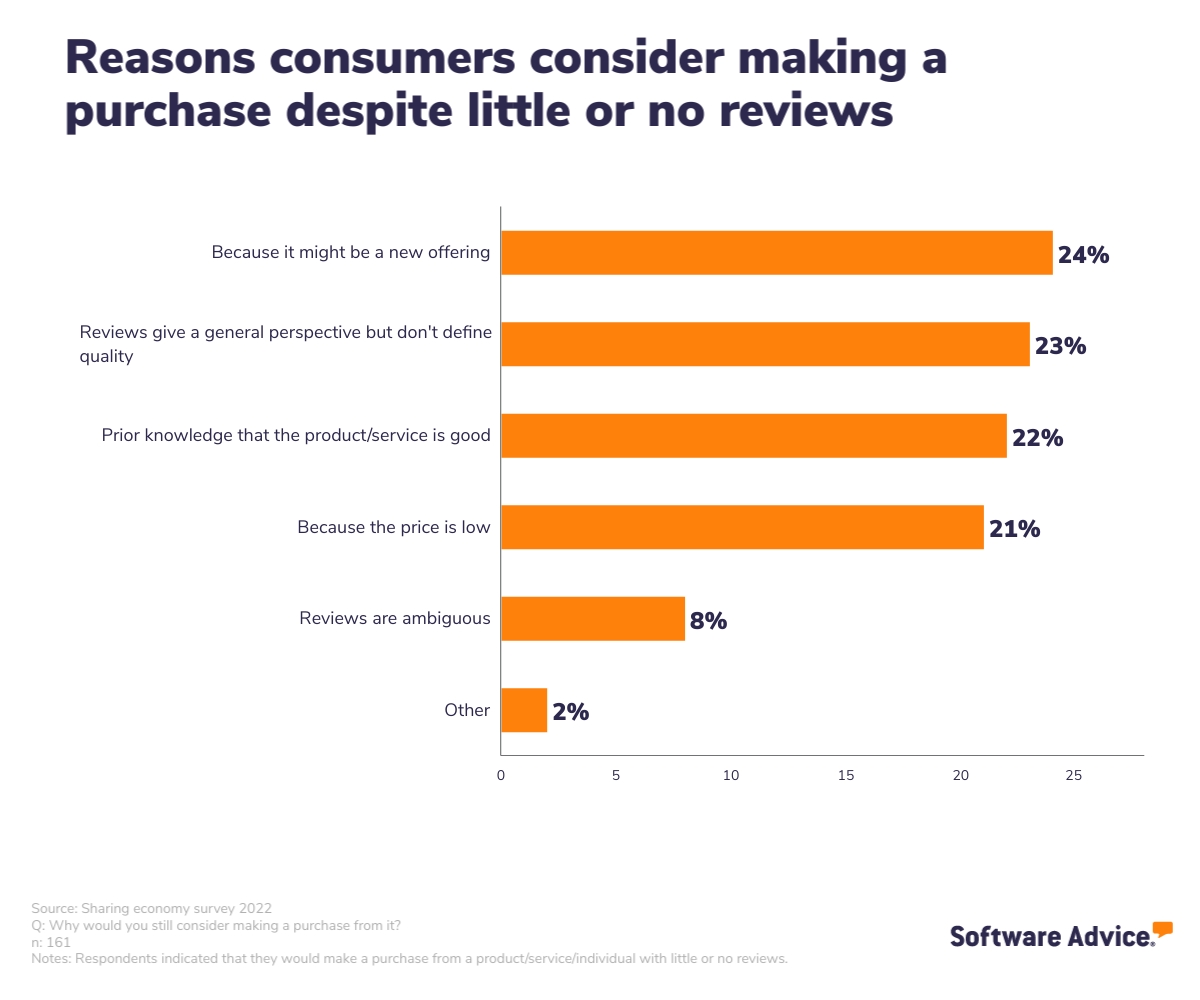

Only 2% of those who buy products or services through sharing economy platforms never read reviews beforehand, and of those who do read reviews, 57% wouldn’t make a purchase if there were few or no reviews available. When we asked those who would still consider making a purchase in spite of a lack of reviews why they would do so, nearly a quarter (24%) said they might make an exception for new offerings.

New products and services on sharing platforms with no or little reviews can reassure their customers by clearly informing them that their consumer rights to repair, replacement, or refund are covered. Where customers express doubts about a new product or service, informative customer support software may help convert them into paying customers.

Reviews and ratings are an integral part of sharing economy platforms whereby they help maintain quality control and standards of products and services, thus enabling a better customer experience. Additionally, review insights were the fourth most cited advantage among 23% of respondents that currently participate in sharing economy practices. Encouraging users to leave reviews should therefore be a fundamental part of the marketing strategy for any products and services offered via sharing economy platforms.

Amid calls for regulation in the sharing economy, the use of reviews and ratings can help guide and inform consumers when making purchasing decisions on sharing platforms. As such, potential abuses can be avoided by making both sellers and buyers accountable in this online market. In the next article in this two-part series, we will take a dive into how consumers use shared transport services and what opportunities exist in this sector.

Methodology

To collect this data, we conducted an online survey in September 2022 in Australia (1,008 participants) that had to fulfil the following criteria:

- Resident in Australia

- Above the age of 18

- Must have identified the generation they belong to

- Understands the concept of a sharing economy (after being shown a definition, respondents were able to select the correct definition of the sharing economy from a choice of four)

This article may refer to products, programs or services that are not available in your country, or that may be restricted under the laws or regulations of your country. We suggest that you consult the software provider directly for information regarding product availability and compliance with local laws.