LendingPad is a cloud-based mortgage loan origination system (LOS) that helps businesses streamline and manage loan...

Software Advice offers objective, independent research and verified user reviews. We may earn a referral fee when you visit a vendor through our links.

Learn more

Our commitment

Independent research methodology

Software Advice’s researchers use a mix of verified reviews, independent research and objective methodologies to bring you selection and ranking information you can trust. While we may earn a referral fee when you visit a provider through our links or speak to an advisor, this has no influence on our research or methodology.

How Software Advice verifies reviews

Software Advice carefully verified over 2.5 million+ reviews to bring you authentic software and services experiences from real users. Our human moderators verify that reviewers are real people and that reviews are authentic. They use leading tech to analyze text quality and to detect plagiarism and generative AI.

How Software Advice ensures transparency

Software Advice lists all providers across its website—not just those that pay us—so that users can make informed purchase decisions. Software Advice is free for users. Software and service providers pay us for sponsored profiles to receive web traffic and sales opportunities. Sponsored profiles include a link-out icon that takes users to the provider’s website.

FRONTeO Loans

About FRONTeO Loans

FRONTeO Loans is a web-based loan origination software, which helps financial institutions manage the entire loan acquisition lifecycle from simulation, scoring, encoding request, analysis, decision to document generation and signature capture.

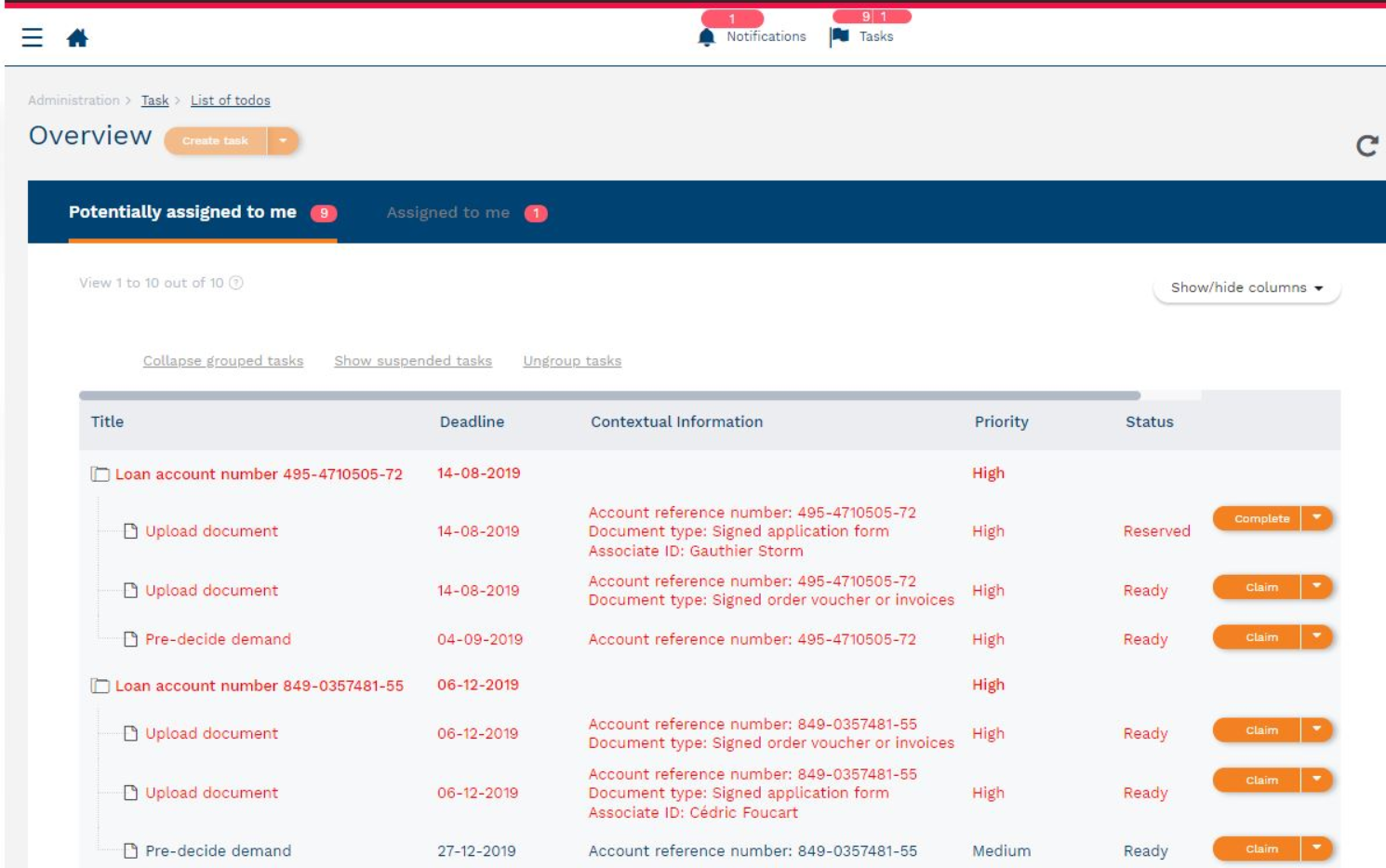

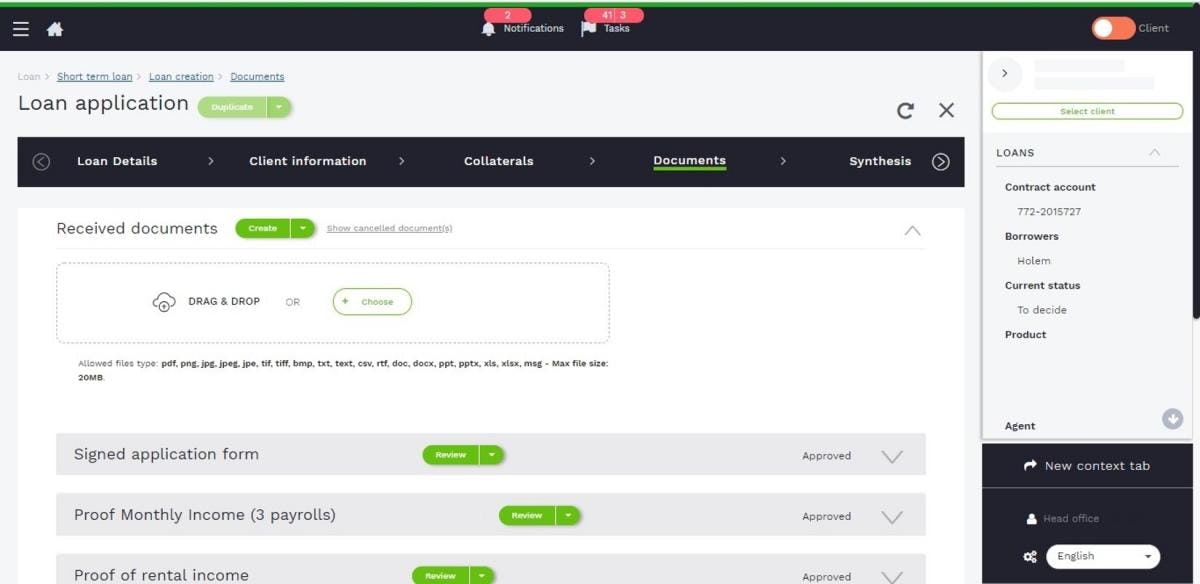

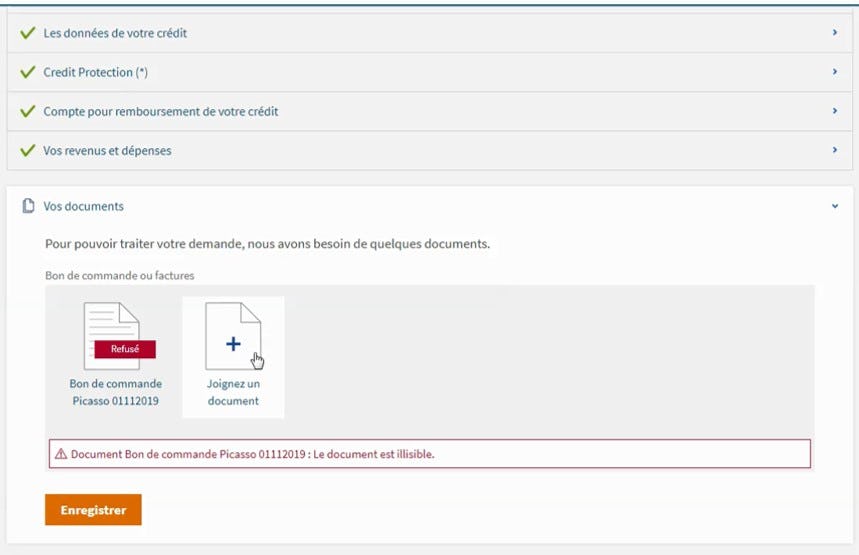

Key features of FRONTeO Loans include loan portfolio management, online application, compliance management, loan disbursement, customer management, loan processing and audit trail. The platform allows users to send notifications to customers and facilitate smooth communication between agents, brokers, clients and the middle and back office.

FRONTeO Loans enables banks to automate the processing of documents through OCR and AI technology, KYC authentication, identity verification, collection of additional information and consultation of national bank files using the built-in rules engine.

Teams using FRONTeO Loans can also generate all types of documents and export them in various formats including DOCX, PFG, XLSX and more using the integrated document management module.

FRONTeO Loans pricing

FRONTeO Loans does not have a free version and does not offer a free trial.

Starting Price:

Not provided by vendor

Show more details

Free Version:

No

Free trial:

No