Allegro Lending Suite

About Allegro Lending Suite

Allegro Lending Suite pricing

Allegro Lending Suite has a free version and offers a free trial.

Alternatives to Allegro Lending Suite

All Allegro Lending Suite Reviews Apply filters

Browse Allegro Lending Suite Reviews

All Allegro Lending Suite Reviews Apply filters

This service may contain translations provided by google. Google disclaims all warranties related to the translations, express or implied, including any warranties of accuracy, reliability, and any implied warranties of merchantability, fitness for a particular purpose and noninfringement. Gartner's use of this provider is for operational purposes and does not constitute an endorsement of its products or services.

- Industry: Banking

- Company size: 51–200 Employees

- Used Daily for 2+ years

-

Review Source

Show more details

We love Allegro

We love this software. It integrates with other vendors we partner with to manage and service our indirect lending program. I would/have recommended this software to others. Can not say enough about service, support, ease of use, dependability, availability and responsiveness of the entire team.

Pros

This software is intuitive and easy to use. It is dependable and makes are job easier and provides a valuable tool to work with our dealer network.

Cons

Nothing we love the product. We were worried switching from DILLS to ALLEGRO-we didn't think it could get better-we were wrong.

Response from Integrated Lending Technologies

We work very hard to make Allegro easy and intuitive to use. One of our top goals is making the customer experience the best in the industry! Thank you for your review and your business! Let us know if we can enhance your experience in any way!

- Industry: Banking

- Company size: 51–200 Employees

- Used Daily for 1+ year

-

Review Source

Show more details

Allegro

It has a lot more features that DILLS (the product we were previously using)

Pros

Easy to use. It has a good workflow. The Alerts help a lot.

Cons

The reporting feature has tons are reports but most are not very helpful. I have tried to edit some of them but the variables are difficult to manipulate and I haven't been able to get the info I would like to have. Would be great to either have options to reports or training on how to change them myself.

The automatic approval matrix could be easier to program. We use that very minimally because it is confusing & not worth the time trying to figure out.

- Industry: Banking

- Company size: 51–200 Employees

- Used Daily for 2+ years

-

Review Source

Show more details

Indirect lending operation

Good but a little over complicated

Pros

Email alerts

Integration with our core

Clear tabbing for review

Auto/Deal Snapshot

Reporting

Cons

Reporting Overly complicated- This needs to be thinned out to more relevant reporting

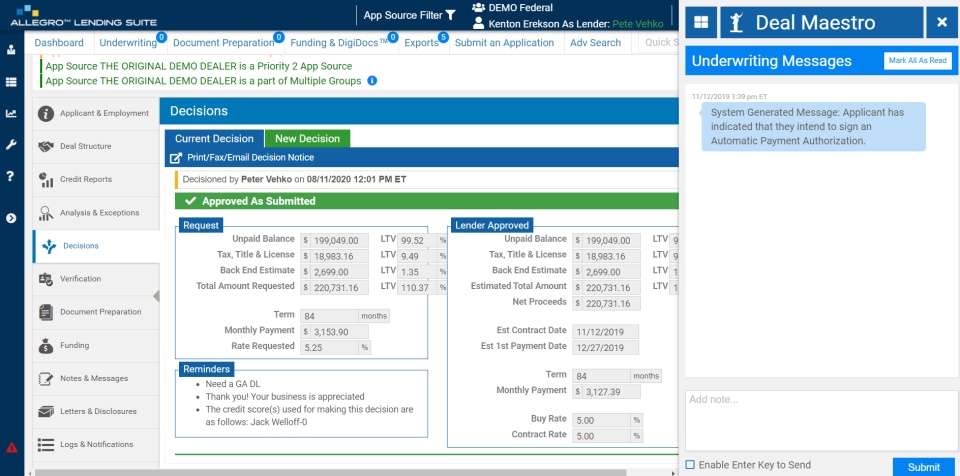

Deal modification needs to be easier- You should be able to modify the submitted deal on the front page. Going to maestro seems unneeded and difficult when mobile

Setting up institutional docs should be an easier process and cross feedable from the dealers input.

- Industry: Financial Services

- Company size: 51–200 Employees

- Used Daily for 1+ year

-

Review Source

Show more details

Allegro system review

very pleased. Anytime we have had problems with the system they are really fast to get it fixed and keep us updated.

Pros

It is really easy to navigate and user friendly.

Cons

In the verification step on the confirm deal tab you have to save it then go back and confirm it. This is really frustrating, I think it should just have to be confirmed once. Other than that nothing every thing else is really user friendly.

Response from Integrated Lending Technologies

Thank you, we appreciate your review and are glad you like the navigation and how easy it is to operate.

We have discussed your feedback regarding the verification tab and realized you are absolutely correct; there is a better and more efficient way to go about it. We will be implementing these changes, if you'd like to add anything please feel free to reach out to us anytime!

Thank you for helping make Allegro better for everyone. It's feedback like this that Allegro was built on!

- Industry: Banking

- Company size: 51–200 Employees

- Used Daily for 2+ years

-

Review Source

Show more details

Great product

We have been using the Allegro Lending Suite/Dills for many years and have been very pleased that we have been able to work with dealerships all over the state and service our members.

Pros

Love that this system organizes and shows necessary information in a legible format to make a decision on a loan request. Also that you can communicate with the dealership via instant messaging.

Cons

Dislike the new updated way to recalculate payment option using the deal maestro. It is not as smooth as I would like.