Neofin

About Neofin

Neofin pricing

Neofin does not have a free version but does offer a free trial.

Alternatives to Neofin

All Neofin Reviews Apply filters

Browse Neofin Reviews

All Neofin Reviews Apply filters

This service may contain translations provided by google. Google disclaims all warranties related to the translations, express or implied, including any warranties of accuracy, reliability, and any implied warranties of merchantability, fitness for a particular purpose and noninfringement. Gartner's use of this provider is for operational purposes and does not constitute an endorsement of its products or services.

- Industry: Banking

- Company size: 11–50 Employees

- Used Daily for 2+ years

-

Review Source

Show more details

We went live much faster than planned

Neofin has made our life so much easier. We have only registered a company and got the first license. We went live much faster than planned and became profitable on the 6th month of operation!

Pros

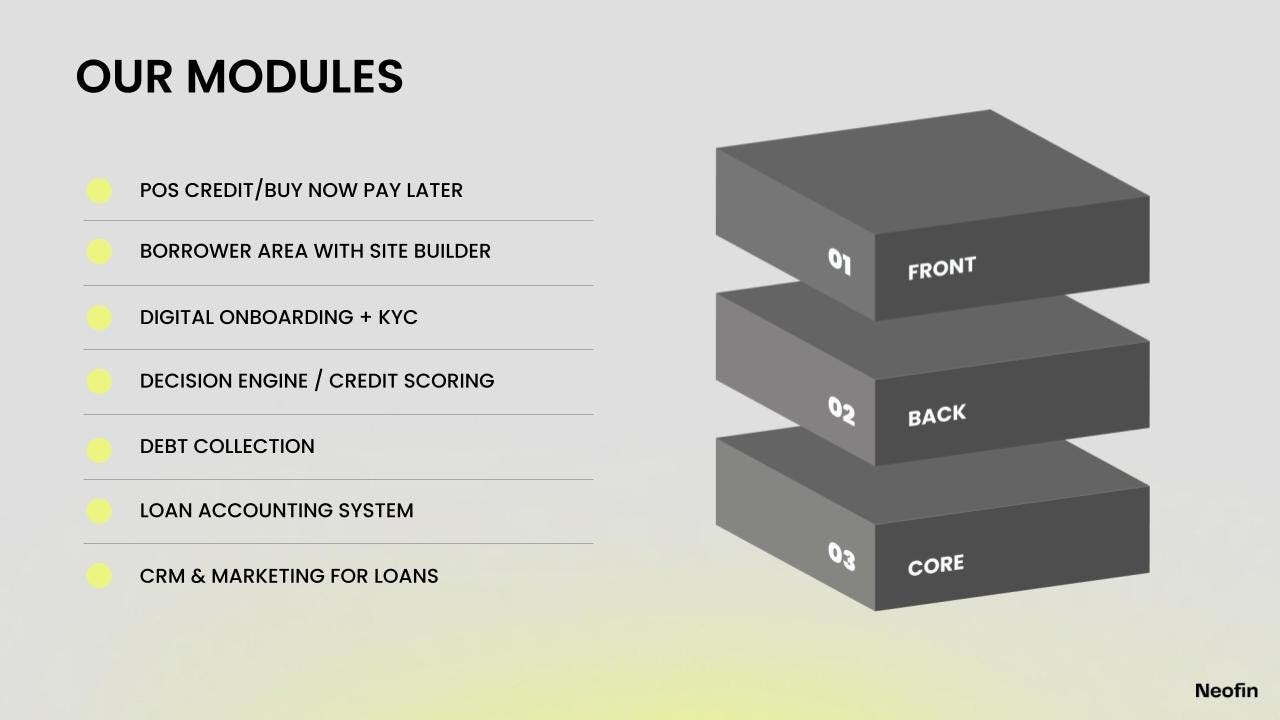

Fully automated system and wide range of all modules allow us to launch our emerging lender startup in just 2 months by saving costs to staff IT department.

Cons

I can’t say I faced any problems with this product, everything went smooth.