Streamline your lending operations and drive growth with Mortgage Automator - a powerful loan origination and servicing...

Software Advice offers objective, independent research and verified user reviews. We may earn a referral fee when you visit a vendor through our links.

Learn more

Our commitment

Independent research methodology

Software Advice’s researchers use a mix of verified reviews, independent research and objective methodologies to bring you selection and ranking information you can trust. While we may earn a referral fee when you visit a provider through our links or speak to an advisor, this has no influence on our research or methodology.

How Software Advice verifies reviews

Software Advice carefully verified over 2.5 million+ reviews to bring you authentic software and services experiences from real users. Our human moderators verify that reviewers are real people and that reviews are authentic. They use leading tech to analyze text quality and to detect plagiarism and generative AI.

How Software Advice ensures transparency

Software Advice lists all providers across its website—not just those that pay us—so that users can make informed purchase decisions. Software Advice is free for users. Software and service providers pay us for sponsored profiles to receive web traffic and sales opportunities. Sponsored profiles include a link-out icon that takes users to the provider’s website.

VeriLoan

About VeriLoan

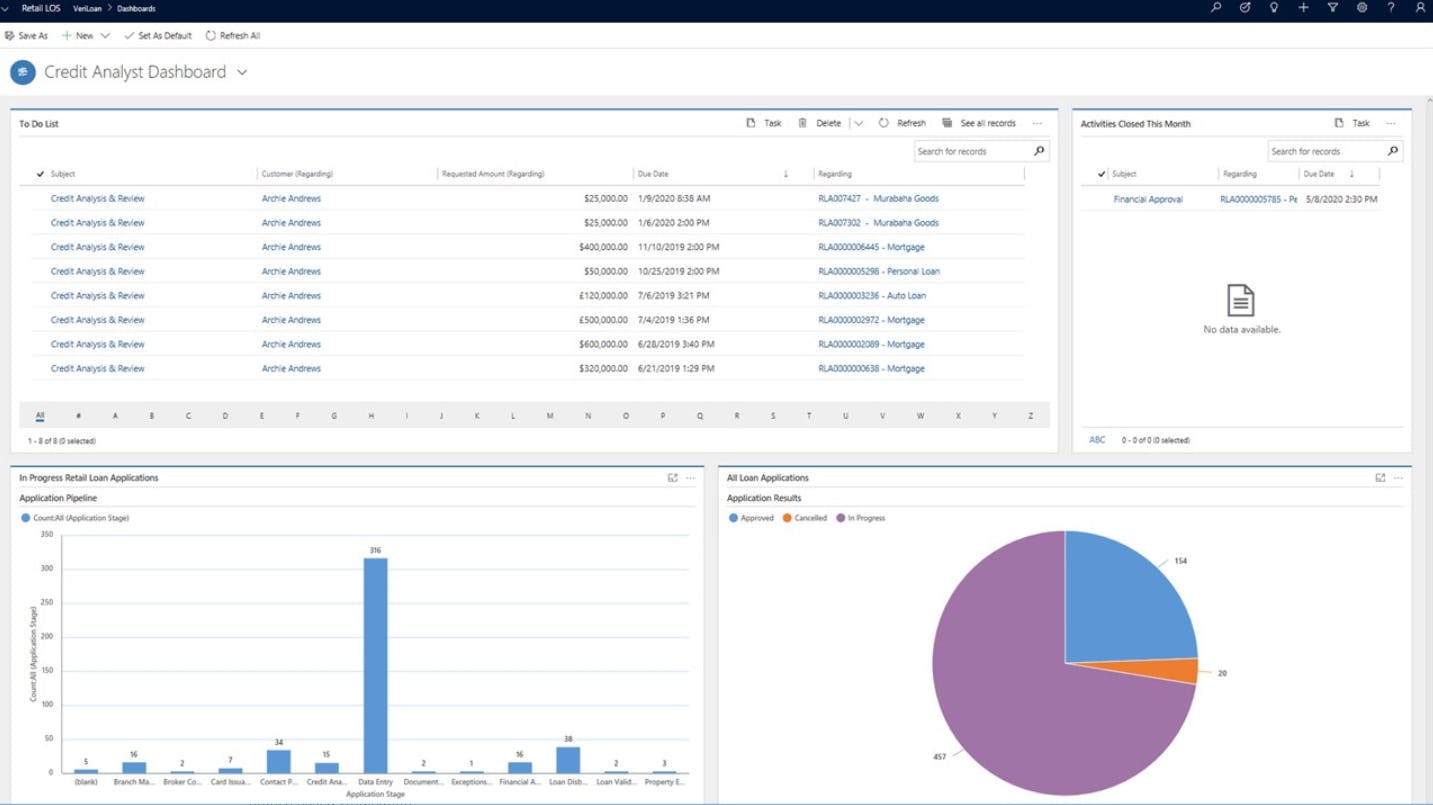

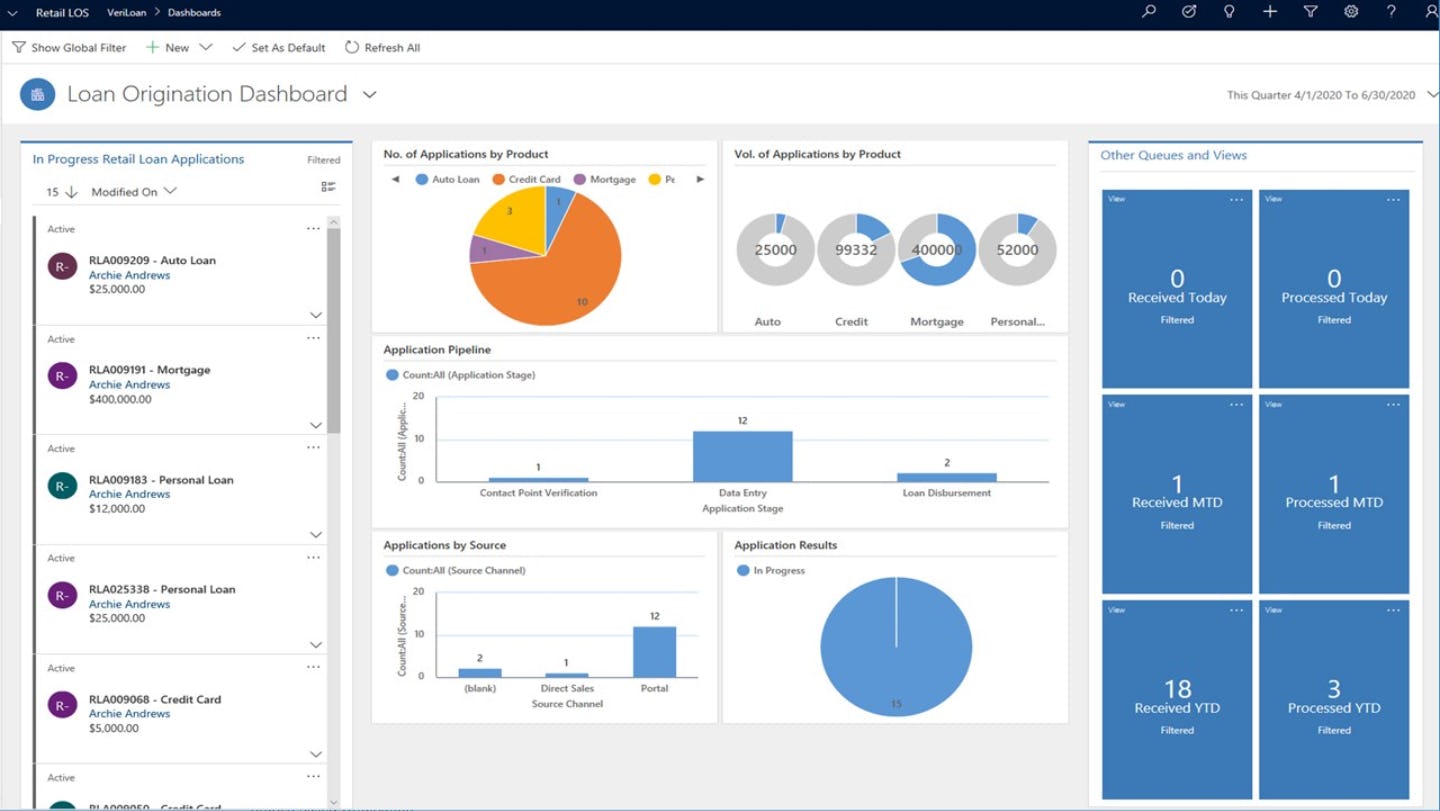

VeriLoan is a digital solution that helps financial institutions manage the entire customer loan lifecycle. It is built on top of Microsoft Dynamics 365 CRM and covers everything from pre-screening and onboarding to risk and credit review, underwriting, disbursement, and collection. It supports retail, SME, and corporate banking loan processes and allows institutions to make cost-effective loan decisions within predefined risk margins.

VeriLoan has several features, including straight-through processing, a rule engine that automates business decisions and processes, simplified KYC and AML check processes, and an advanced eligibility calculator. The solution integrates with external systems like credit bureaus to enable speedy risk assessments. It also coordinates different teams from relationship managers to credit analysts, to streamline the loan origination workflow.

By digitizing the entire loan lifecycle, VeriLoan helps financial institutions reduce turnaround time, error and return rates, and the cost of client acquisition. It also improves client and employee experiences through features like a self-service loan portal and increased workflow efficiency with OCR and PDF upload capabilities.

VeriLoan pricing

VeriLoan does not have a free version and does not offer a free trial. VeriLoan paid version starts at USD 1.00.

Starting Price:

USD 1.00

Free Version:

No

Free trial:

No