LendingPad is a cloud-based mortgage loan origination system (LOS) that helps businesses streamline and manage loan...

Software Advice offers objective, independent research and verified user reviews. We may earn a referral fee when you visit a vendor through our links.

Learn more

Our commitment

Independent research methodology

Software Advice’s researchers use a mix of verified reviews, independent research and objective methodologies to bring you selection and ranking information you can trust. While we may earn a referral fee when you visit a provider through our links or speak to an advisor, this has no influence on our research or methodology.

How Software Advice verifies reviews

Software Advice carefully verified over 2.5 million+ reviews to bring you authentic software and services experiences from real users. Our human moderators verify that reviewers are real people and that reviews are authentic. They use leading tech to analyze text quality and to detect plagiarism and generative AI.

How Software Advice ensures transparency

Software Advice lists all providers across its website—not just those that pay us—so that users can make informed purchase decisions. Software Advice is free for users. Software and service providers pay us for sponsored profiles to receive web traffic and sales opportunities. Sponsored profiles include a link-out icon that takes users to the provider’s website.

FinStack

About FinStack

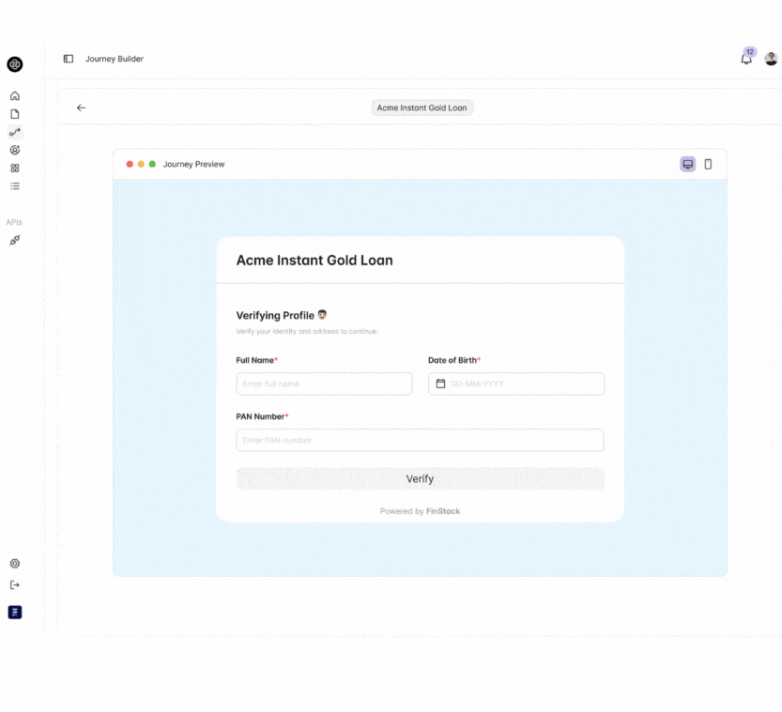

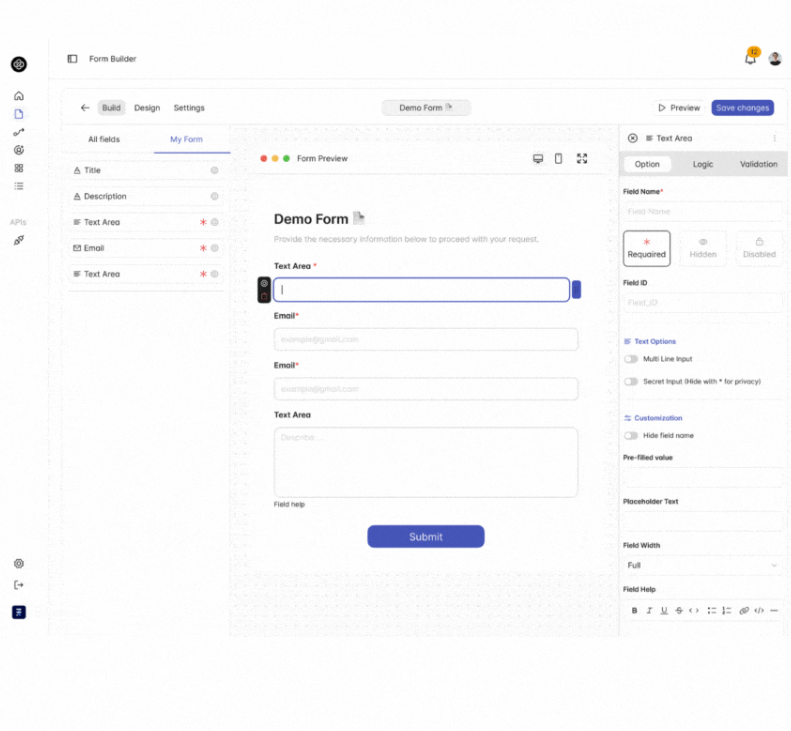

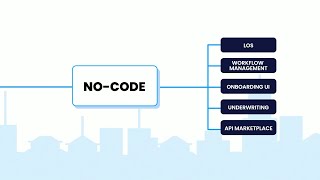

FinStack is a no-code loan origination system (LOS) designed for financial institutions to manage and launch loan products without requiring engineering resources. It supports banks, NBFCs, loan service providers (LSPs), and direct selling agents (DSAs) in the Indian financial market. The platform accommodates various loan products such as personal loans, home loans, education loans, vehicle loans, and gold loans. It is built to help lending organizations scale operations while adhering to RBI regulations.

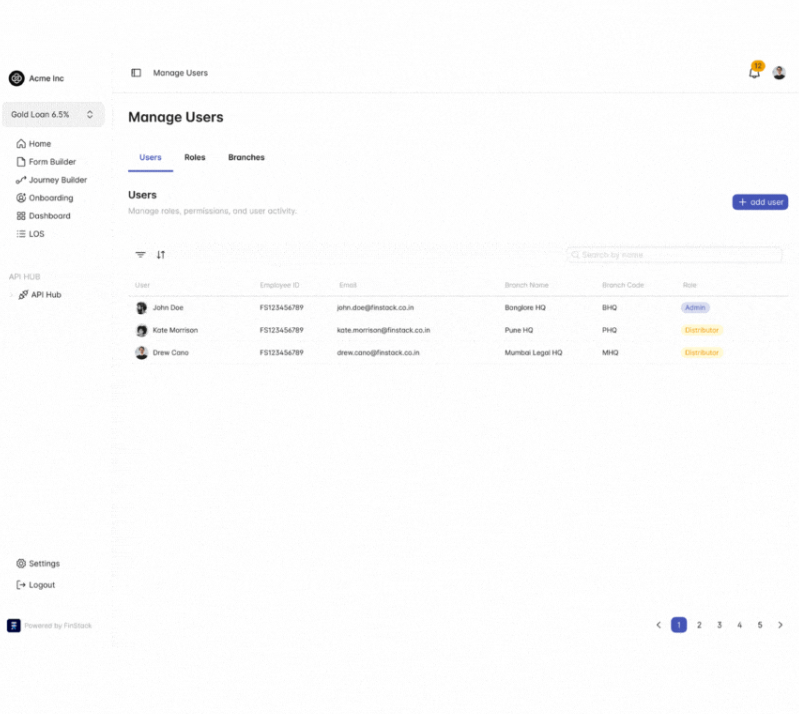

The system operates in a no-code environment, allowing users to make real-time adjustments to borrower journeys and credit policies. It includes an API marketplace tailored to the Indian FinTech ecosystem and supports deployment on the cloud infrastructure of the client’s choice. Various onboarding options are available, enabling staff to assist borrowers or input data on their behalf. The platform offers role-based access control, maker-checker workflows, and customizable user hierarchies for branch-level management.

The visual rule builder allows simulation and testing of credit policies. The system supports compliance with RBI regulations and digital lending guidelines. Financial institutions can manage DSA networks, embed loan products into partner applications, and facilitate co-lending or lead-sharing arrangements. Data is securely hosted on the client’s chosen cloud environment, ensuring full control over information.

FinStack pricing

FinStack does not have a free version but does offer a free trial. FinStack paid version starts at INR 25,000.00/month.

Starting Price:

INR 25,000.00/month

Free Version:

No

Free trial:

Yes