MeridianLink DecisionLender

About MeridianLink DecisionLender

MeridianLink DecisionLender pricing

MeridianLink DecisionLender does not have a free version and does not offer a free trial. MeridianLink DecisionLender paid version starts at USD 3.00/month.

Alternatives to MeridianLink DecisionLender

All MeridianLink DecisionLender Reviews Apply filters

Browse MeridianLink DecisionLender Reviews

All MeridianLink DecisionLender Reviews Apply filters

This service may contain translations provided by google. Google disclaims all warranties related to the translations, express or implied, including any warranties of accuracy, reliability, and any implied warranties of merchantability, fitness for a particular purpose and noninfringement. Gartner's use of this provider is for operational purposes and does not constitute an endorsement of its products or services.

- Industry: Banking

- Company size: 201–500 Employees

- Used Daily for 2+ years

-

Review Source

Show more details

Highly Customizable, Powerful, and Capable LOS - but Know Your Organization's Limits

Overall DL4 is a great SaaS and is perfect for lenders that have appropriate expectations that align with their organziational structure and strategic direction.

Key factors to consider are if your organization

- already has fullstack developers onstaff (or will hire them)

- already has (or will hire) a dedicated and capable analytics department

If either the above is a "no" or any bit doubtful, then consider a one-size-fits-all solution like ML Consumer which is a best of all worlds and has a lot of the DL4-inspired functionality in a boxed solution. Many of the best features were integrated after ML acquired TCI's DL4.

Additionally, having attended several of the ML Live conferences and spoken with customers of multiple LOS solutions and core systems, the organizations that have the appropriate staffing, LOVE DL4 and they speak highly about their configurations and system capability.

That being said if your organization isn't 100% behind supporting the LOS adoption, then consider ML Consumer that has a ton of powerful built-in analytics and some really powerful tools that are not available in DL4 without on-staff fullstack developers to build them. The Consumer addtions are inspired by DL4.

Lastly, if your organization's analytics support isn't top tier, it will be an additional lift to build critical LPI/KPI/Leadership reporting, and you'll be at the mercy of development cycles outside of your team and possibly outside of your oganization if you want anything more than basic data extracts.

Pros

I enjoy the high level of customization - DL4 can literally do just about anything your organization wants or needs. With a full stack developer and capable analytics staff, you can make this platform into a perfect-for-you custom tailored solution. DL4 allows you near-full customization where other platforms have development or user roadblocks.

Cons

Being at a non-development oriented organization, we did not have full-stack development staff and found that we had more friction with customization than anticipated during RFP, and customizations / enhancements that we had road mapped (AI integration, advanced dashboards, etc) were delayed due to organizational factors more than ML.

- Industry: Banking

- Company size: 11–50 Employees

- Used Daily for 2+ years

-

Review Source

Show more details

Every interaction that we have ever had with the team at TCI has been positive. They are so...

Because the product is so efficient, we are able to close more deals and provide faster response times, which sets us apart from other lenders in the industry.

We're also able to keep a good touch on every level because the reporting functionalities are so superior.

Pros

The functionality and features of the product are what we like best. Because all of the information that we need to make a decision is at our fingertips, TCI allows us to make quick decisions which our dealers appreciate and continue to rave about. Our average decision time went from over 15 minutes to less than 3 minutes, which allows us to close more deals and solidify our relationships with the dealers. Many of our dealers have communicated that we are their preferred lender because of how quickly we can decision an application.

We have also found the reporting capabilities to be far beyond comparison of other products that we have used.

Cons

If I had to choose one thing that I don't like right now, I would have to say it would be the process to make changes to rules, however; we're currently looking at upgrading to Decision Lender 4, which will allow us to make the changes within minutes and really elevate our lending products.

- Industry: Banking

- Company size: 501–1,000 Employees

- Used Daily for 1+ year

-

Review Source

Show more details

Bad Implementation

The implementation for this product was terrible. It took a year longer than they said it would, and it still isn't right.

Pros

The product seemed like it would fix our business need for decisioning car loans applications, but it has not yet worked out for our favor.

Cons

The customization piece is very poor. If you want to create your own decisioning rules and have they actually work, good luck!

- Industry: Banking

- Company size: 51–200 Employees

- Used Daily for 1+ year

-

Review Source

Show more details

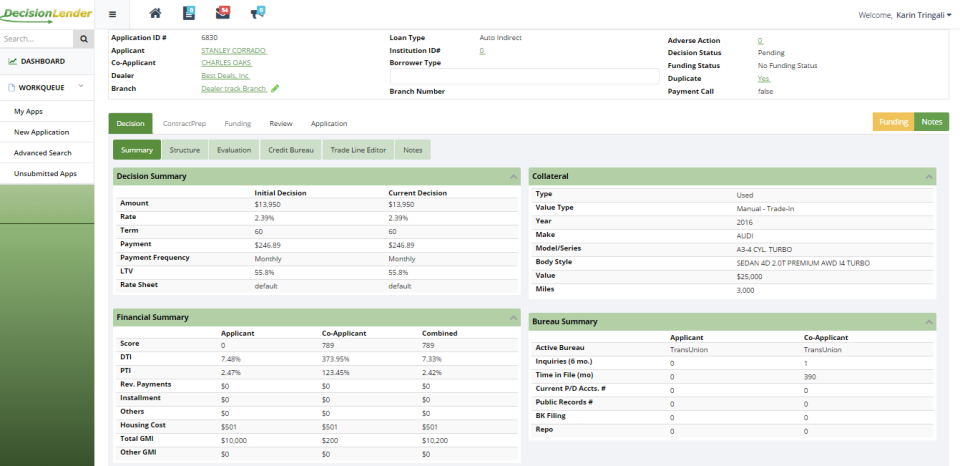

TCI's integration w/ Dealer Track & Route One has helped us increase applications & book loans

Everyone with TCI is very helpful. From the very beginning TCI introduced us to other end users. TCI helped to facilitate a visit with one user so we could see first hand how the software works and the integration with our core system. The implementation team was great on assisting and walking us through the steps of set up and building our software to meet our current policy and procedures. TCI staff was available to help us after we launched and went live with Decision Lender. Follow up with us by our representative has been consistent and appreciated.

Pros

The integration with Symitar, Dealer Track and Route One. The ability to have system approvals.

Funding is very easy.

Cons

Decision Lender 3.5 does not allow system counters or underwriting adjustments on the fly. To have these features we will need to upgrade to 4.0.

- Industry: Banking

- Company size: 51–200 Employees

- Used Daily for 2+ years

-

Review Source

Show more details

Indirect Software

Excellent system with great workflow! Heartland Credit Union has been a user since 2012. We could not have processed an average of over 1000 applications per month (in a timely manner with existing staff) if we did not have this software.

Pros

Intuitive and great workflow. Easy to use and train.

Cons

There have been a few times the system has gone down in the last year for various reasons. Indirect is a "time game", so it is difficult when this happens. We have probably been spoiled since we had very little down time for the first 3 years on the system.

- 1

- 2